“A gray rhino is a highly probable, high impact yet neglected threat” – Michele Wecker

Currently, we are facing a grey rhino situation, the outbreak of the Corona-COVID19 disease. It is highly probable, we have outbreaks about every 4 years, it has a potentially high impact and we neglected the threat.

The article highlight how Blockchain technology can help to design a more resilient IT architecture to ensure availability of critical digital infrastructures like banking services or public sector services. I consider streaming services and e-commerce not as crucial.

A short history of IT Architecture archetypes

Almost all the digital services we are using today are centrally hosted. That means running in central data centers (with backup/failover/standby datacenter). The cloud approach moves even more services to a few single providers.

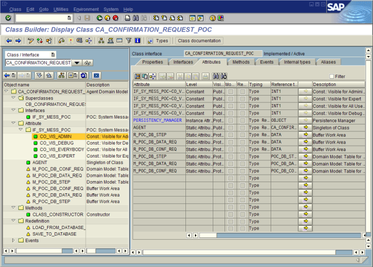

A short overview of the history of IT architectures. In the beginning, all IT applications have been cloud-based. You connected via a terminal to a central computer who does all the calculations for you and delivered back the result. The terminal was just a user interface.

The next main architecture archetype moved the computation to the desktop, you installed a program on the desktop and the computation was done on the computer, in some cases you wrote back data to a central database. The disadvantage was, that updates have been really cumbersome. All desktop applications have to be updated, normally on various operating system setups. Real pain for the developer and the operating crew.

The latest architecture is cloud-based, application moving back in the datacenter aka cloud and the user has an interface on his device. On the desktop it is the browser on a mobile device it is normally an app. That has a huge advantage in development and support, you fix it once at a central point and it’s done. Updated once and everybody has it. The disadvantage is, which I wanted to highlight in the article if the datacenter goes offline, the service is offline. A lot of apps did not even work without being online. People born around 2000 have an always-on mentality, they don’t have their music collection physically on their devices.

The Gray Rhino Situation

The current crisis puts our necessary digital infrastructure in jeopardy. All critical services are based on central architectures. Our banking accounts live in the datacenter of our bank, our citizen data are stored in datacenters of the government, and so on. If a datacenter is not available (and the backup datacenter) because people who run the facility simply cannot show up for work, the services are not available.

Imagine your online banking is not available, you cannot get cash from your ATM, the POS terminals are offline, your credit card is not working, you cannot get a passport, driving license or other certificates or documents necessary. I am sure that won’t be a big issue if the outage is just some hours or a day. But I am not sure what it would mean for our digital-based society if the outage lasts longer.

Blockchain aka Distributed Ledger Technology (DLT) aka Decentralized Systems

We have centralized services and a gray rhino situation. How can Blockchain help? In the last years, the technology has developed from hype to a “solid” technology component. Use cases have emerged in which the technology enables completely new business models and architectures. The main use cases are Central Bank Digital Cash (CBDC), Decentralized Identity and Digital Assets. The first two one can be considered as crucial public infrastructure. If you want to avoid that cigarettes are used as currency a available and trusted currency is needed. CBDC and Decentralized Identities are based on decentralized concepts and IT architectures. If the systems are design well, they are not relying on the availability of one single party.

Central Bank Digital Cash

CBDC is different from digitalized money on your banking account. It can best be compared with physical cash. It is an obligation from the central bank and not from your retail bank. If a CBDC system is designed with resilience in mind, which means various stakeholders running nodes. The availability of one system is not crucial anymore.

CBDC would have additional advantages, central banks could react fast on the new situation without being dependent on other institutions like banks. Interest rates on digital cash can be adopted, money can be provided without banks if they are offline and even helicopter money can be provided in an exceptional situation.

Decentralized Identity

The principal of Decentralized Identities is that an issuer is issuing a document to the holder directly. The document stays on the device of the holder. In case of a driving license, the issuing authority transfers the digital driving license to the driver, normally his smartphone. In addition, some data necessary for validation and revocation are stored in a decentralized ledger. No GDPR relevant data is stored on the ledger! In contrast to central systems, it is now possible to validate the credential without the issuing authority. No central register is needed to check the authenticity of the driving license.

Even in a complete network outage, the authenticity of the credentials can be checked.

Conclusion

Blockchain and DLT can not only help to implement new business models. It can also help to develop the next generation of IT architecture which is more resilient against black swans and gray rhinos and can scale better.

After Corona is before Corona.